When considering what area to buy a home a significant part of your decision making may be what the property taxes are in the town your dream home is located in.

Some towns have many schools, hospitals and less industry. This is where the burden is higher for the homeowners of the community.

Some towns in Connecticut have seen property tax increases, but this year for 2016 Milford, Connecticut has dropped its Mill rate from 27.88 to 27.84 for the 2016-2017 tax year. However, this is only the second time taxes have gone down in the last 30 years (CT Post). http://www.ctpost.com/local/article/Milford-tax-rate-goes-down-a-little-7468222.php

Other places like Milford, Connecticut 06460 have a huge commercial base that contributes and hereby reduces the tax burden on homeowners.

Milford covers 22 square miles in New Haven County. There are approximately 21,199 households*

The median household income for Milford, Connecticut is $80,743, where the median for the state is $69,899*

The five largest employers are; Servicom llc, Schick-Wilkinson Sword, Doctor’s Associates Inc, Milford Hospital, Subway World Headquarters

And the top five contributor’s on the Grand list are;

Connecticut Post Mall $135,310,262

Connecticut Light and Power $109,403,339

Milford Crossing Investors $61,950,000

Wolff $51,316,641

JP Construction $28,200,980

Total: $6,440,527,586*

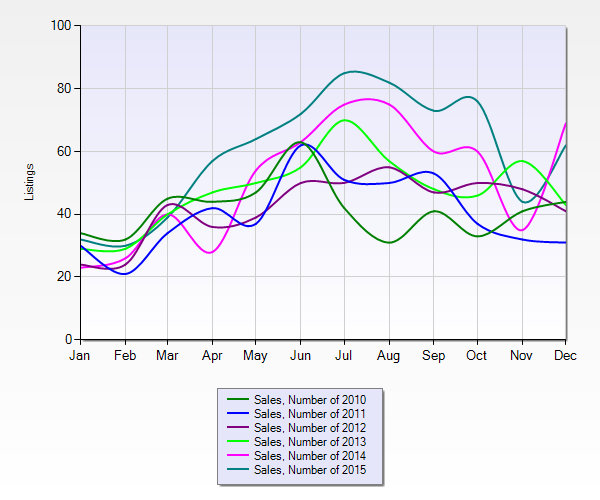

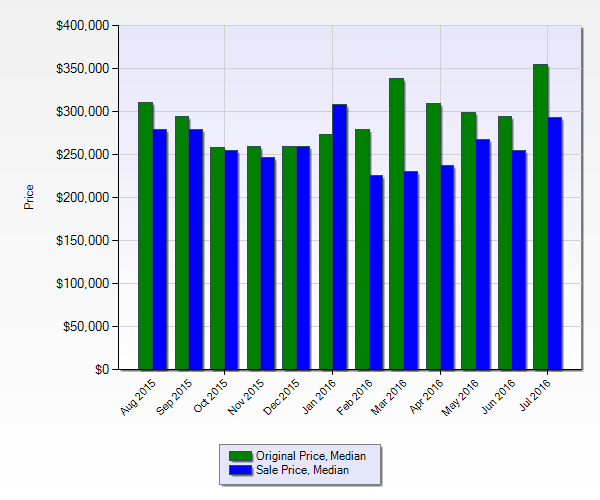

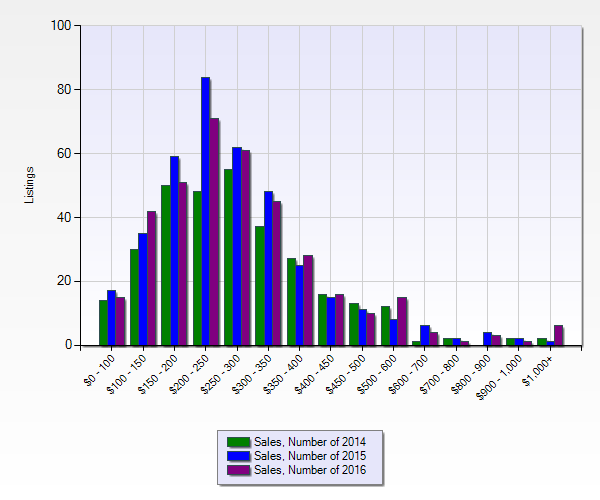

July 2016 Market Report for Milford, Connecticut

405 Actives homes for sale on the Multiple listing service

343 homes have closed in the last 180 days

163 homes are under contract in the last 180 days